Zelle review: Instant cash, as long as you’ve using the right bank - noltingthallow1939

At a Glance

Practiced's Rating

Pros

- Instant and rid cash transfers

- Robust bill-splitting tool

Cons

- Mustiness have a Zelle write u to send or encounter money, or to split a chink

- Both parties must be customers of Zelle-partnered banks to get instant cash transfers

- No quotation cards allowed

Our Verdict

At one time you're all signed up and if you're a customer of a participating coin bank, Zelle offers unrivalled of the fastest slipway to send and receive money with your friends. Merely if you're non registered with Zelle yet or your bank isn't a Zelle pardner, the app's benefits begin to fade.

The Zelle mobile defrayal app is the major banks' way of saying they'Re not content to sit back and let the red-torrid peer-to-match payment trend pass them by. So some of them banded unneurotic to cook Zelle, a slick money-sending app that aims to go manoeuvre-to-head with the likes of Venmo, Square Cash, and Google Wallet. Zelle lacks the cool factor of an app equal Venmo, simply it's got an ace up its sleeve: instant and disembarrass cash transfers. Tempting, but there's a grab.

Zelle may receive your bank behind it, but it's not the only option. Arrest out the early mobile payment apps we reviewed.

Setup

Getting started with Zelle is easy: Download the app (note: Zelle may also be integrated into your bank's mobile app, so check there prototypic), enter your phone figure, select your bank, control your account with an SMS-delivered passcode, and then add your debit circuit card.

Sending and receiving money

Three jumbo buttons dominate the silklike and simple Zelle interface: Institutionalise, Call for, and Split. To transfer money with a friend, you tap Send or Postulation, tap in the sum you want to pay or get, past find their name in your computer address book—or plainly type in their number or email handle.

Ben Patterson / IDG

Ben Patterson / IDG Zelle's main interface is sleek and simple.

You can send money to Oregon request cash in from anyone victimization Zelle, but the recipient role volition have to jump through a hardly a hoops if they're not already signed up with the service. If the attached recipient of your cash or money request is a customer of a active Zelle swear, they'll need to register victimisation the Zelle app, their bank's website, Beaver State their savings bank's mobile app. (My Citi app, for example, has a "Institutionalize Money with Zelle" section that moldiness be activated before being old.) If your ally's bank doesn't process with Zelle yet, they'll need to download the Zelle app, enter their debit card information, and then wait a Day operating room indeed for the money to land in their bank account.

As anti to the other P2P payment apps in this roundup, Zelle promises nearly instantaneous—and, crucially, free—cash transfers, with no share operating theater per-transaction fees. The catch? To get free trice transfers, both your savings bank and the cant of the friend you're exchanging cash with needs to be partnered with Zelle. Among the banks that currently keep going Zelle: Bank of America, Citibank, Capital One, Chase, H. G. Wells Fargo, and active a dozen others. (Zelle claims the list of participating Banks—non all of which have activated service with Zelle yet—is growing 24-hour interval by day.)

Ben Patterson / IDG

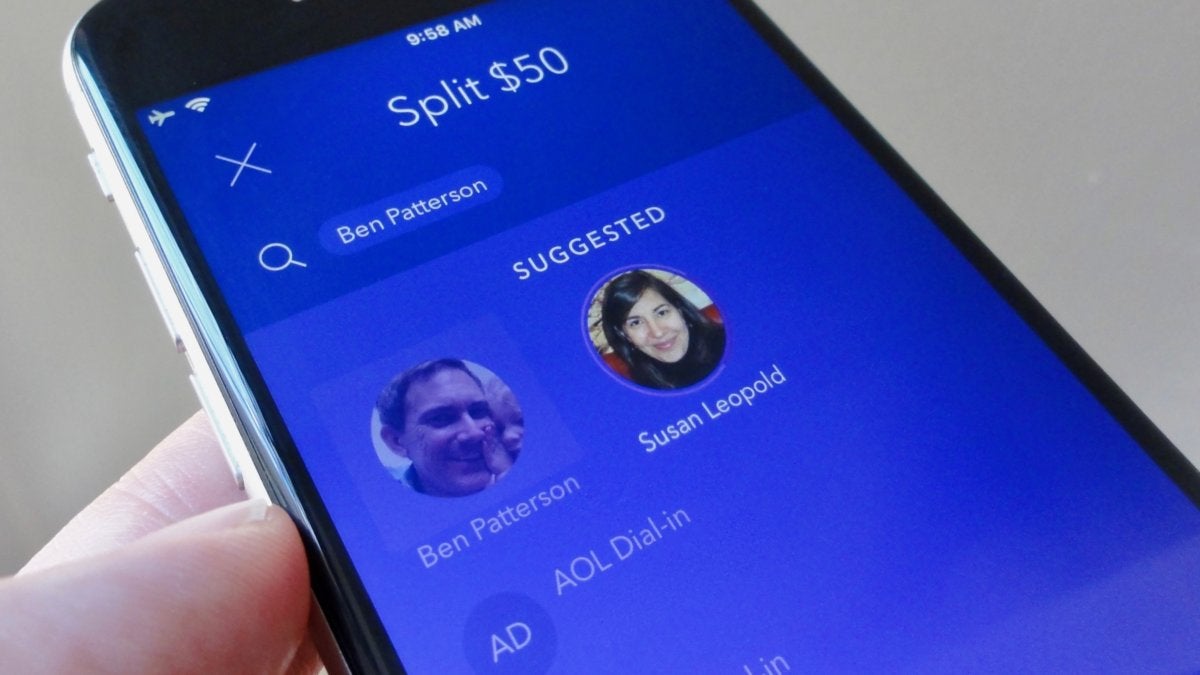

Ben Patterson / IDG Zelle offers one of the more robust bill-rending feature we've seen in a P2P payment app, but you can't divided the check with anyone who isn't already enrolled with Zelle.

Zelle offers one of the better bill-splitting tools among the apps in our roundup. Tp Disconnected, enter the total amount of the bill, select the friends with whom you'd like to split the check, then tap Split or set the amounts pro re nata—and yes, your portion of the bill is included in the calculations. Nice, but hither's the rub: Zelle North Korean won't let you break the bill with anyone who hasn't registered with Zelle yet. Ugh.

Fees and limits

If your depository financial institution isn't partnered with Zelle, you'll live limited to sending no longer than $300 over a rolling long period, although Zelle may, at "its discretion," lift your spending chapiter. If your bank is a penis of Zelle's network, you'll cause to concern to your bank for whatsoever spending/receiving limits.

Zelle doesn't charge anything for hard cash transfers, including its "instant" transfers, only you give notice solitary transfer money victimization bank accounts and debit card game; no credit cards allowed, which means your credit placard company dismiss't act every bit a buffer between you and potentially fraudulent charges.

Security

The Zelle app gives you the option of using touch ID to sign into the app, a fairly typical boast among the apps in our roundup. Also typical is Zelle's admonition against using the app to pay anyone you don't roll in the hay, operating room for buying goods and services from strangers.

Zelle is superfine for rely integration

Once you're all signed up and if you're a customer of a participating bank, Zelle offers one of the fastest ways to send and meet money with your friends. But if you'Re not registered with Zelle sooner or later or your bank ISN't a Zelle partner, the app's benefits start to fade.

Source: https://www.pcworld.com/article/407479/zelle-review.html

Posted by: noltingthallow1939.blogspot.com

0 Response to "Zelle review: Instant cash, as long as you’ve using the right bank - noltingthallow1939"

Post a Comment